|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

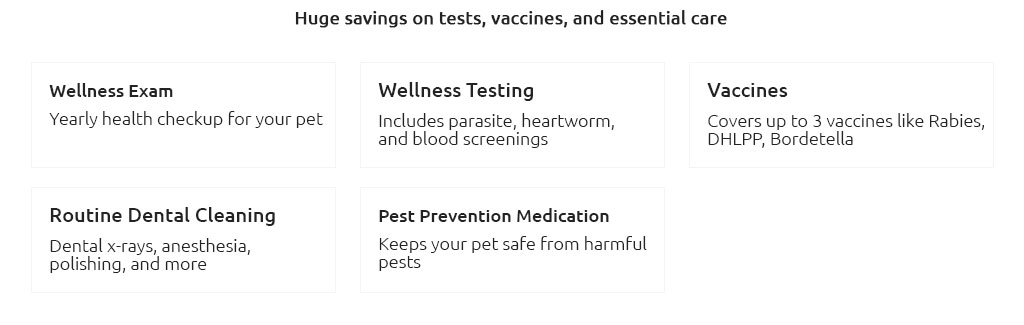

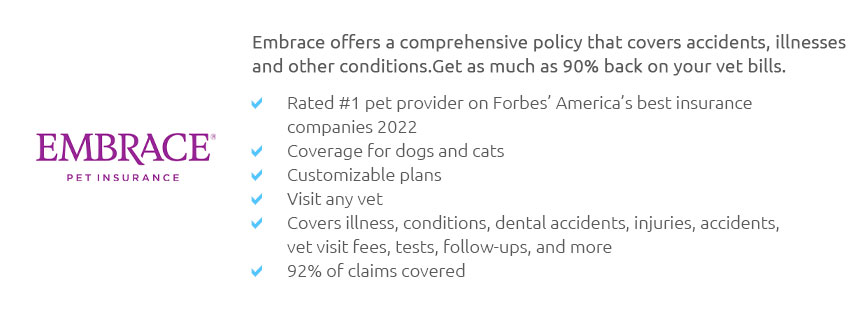

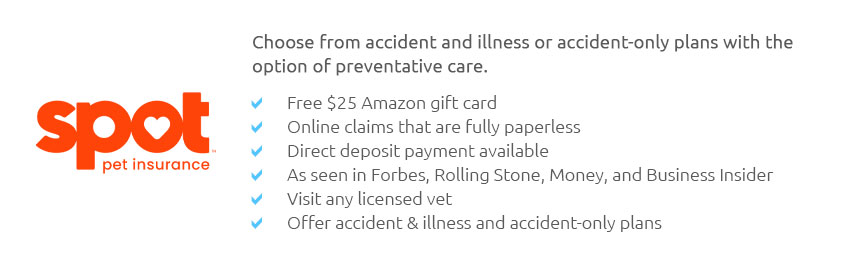

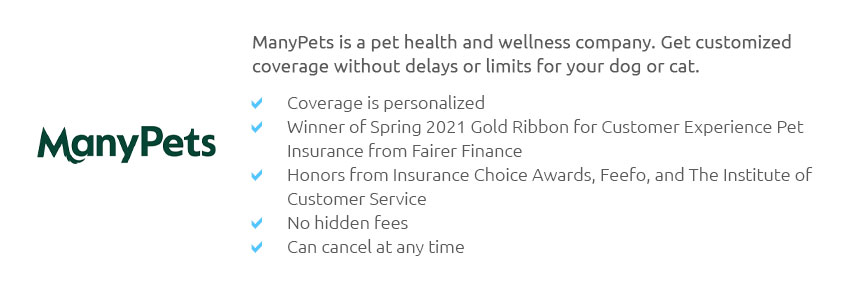

do dogs have medical insurance and how to decide if now is the right timeShort answer: dogs do not automatically have insurance, but owners can purchase pet health insurance that reimburses eligible veterinary costs. Strictly speaking, it's not the same regulatory category as human medical insurance; it's a reimbursement product designed for veterinary care. What it actually coversMost policies center on accidents and illnesses. Wellness (vaccines, routine exams) is usually an optional add-on. Pre-existing conditions are excluded, and waiting periods apply.

That sounded broad; more precisely, coverage hinges on the policy's definitions, medical records review, and whether the condition first appeared after enrollment and waiting periods. Costs and value, brieflyPremiums commonly range from about tens to low hundreds per month depending on age, breed, and location. Deductibles (often $100 - $500), co-insurance (typically 70% - 90%), and annual limits ($5k - unlimited) shape total value. Consider your dog's risk profile and your tolerance for large, sudden bills. Decision timing: why "when" mattersEarlier is better if you plan to insure. Enrolling a puppy or healthy adult usually locks in broader future eligibility. Waiting until after a diagnosis often means that issue is forever excluded. For seniors with established conditions, accident-only coverage or disciplined savings may fit better. If adoption is this week and you're unsure, a short gap strategy - month-to-month accident coverage while evaluating comprehensive plans - can reduce immediate exposure. How to select without overthinking

Common pitfalls to avoid

A quiet real-world momentAt a Sunday-night emergency clinic, the receptionist asks, "Do you have pet insurance?" The vet will treat either way, but having a policy often shifts the owner's focus from payment logistics to care decisions; without one, a deposit discussion may come first. Alternatives if you decide not to insure

Final guidanceDecide before the next notable health event. If your dog is young and healthy, enrollment now preserves the widest future coverage. If middle-aged, review records for past issues that could be excluded, then choose a plan that still protects against high-cost surprises. If conditions are already documented, refine the goal: protect against new accidents and illnesses or commit to a disciplined savings plan. Either path is valid; the key is selecting on purpose, not under pressure.

|